Invest

Trust Deed Investing

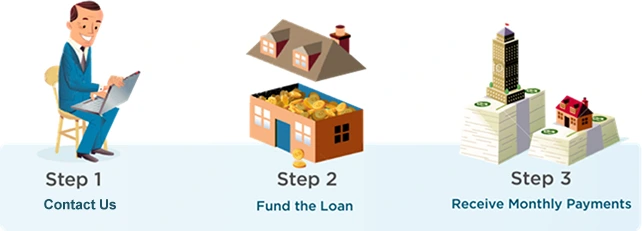

Church Capital provides Investors the opportunity to easily and securely lend on real estate while earning huge returns. Safely diversify your portfolio with ‘Trust Deed Investments’ that are secured by real properties with considerable equity that protects your investment principal. Enjoy fixed monthly interest payments on short term investments that range from 1-5 years.

Banks have been enjoying for years the high yields by investing in mortgages from your savings and money market deposits. Now Church Capital’s investors can enjoy the lions share of the yields that has been reserved only to large lending institutions. Investors have the opportunity to hand pick loans and customize their investment portfolio according to their own investment strategy.

Trust Deed Investing

Church Capital provides Investors the opportunity to easily and securely lend on real estate while earning huge returns. Safely diversify your portfolio with ‘Trust Deed Investments’ that are secured by real properties with considerable equity that protects your investment principal. Enjoy fixed monthly interest payments on short term investments that range from 1-5 years.

Banks have been enjoying for years the high yields by investing in mortgages from your savings and money market deposits. Now Church Capital’s investors can enjoy the lions share of the yields that has been reserved only to large lending institutions. Investors have the opportunity to hand pick loans and customize their investment portfolio according to their own investment strategy.

REQUEST OUR LIST OF TRUST DEED INVESTMENT OPPORTUNITIES TODAY

Fill out the form below and one of our loan placement specialists will contact you shortly. Thank you.

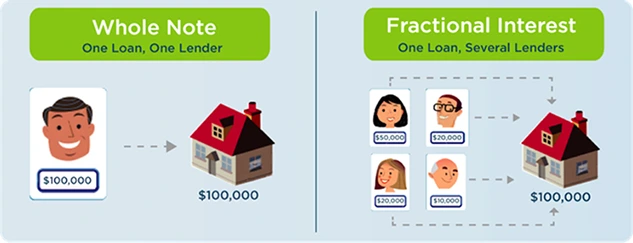

Whole & Fractional Interests

– Whole Notes

Investors can purchase a whole notes secured by entirely by the one subject property. This single investor would own the entire note and would receive the borrower’s entire monthly payment, less servicing fees.

– Fractionalized Notes

Fractional notes are single whole notes secured by the subject property and is owned by an undivided interest between 2 to 10 lenders. Each investor receives a pro rata share monthly of the borrower’s payment and has voting rights equal to their share of the investment.